The History of Interest Rates…What’s Next?

Everything is going up, up, up (The Rolling Stones - Shattered). OK, Mick Jager didn’t say that everything is going up, it was the crime rate, but it sounded good for this blog.

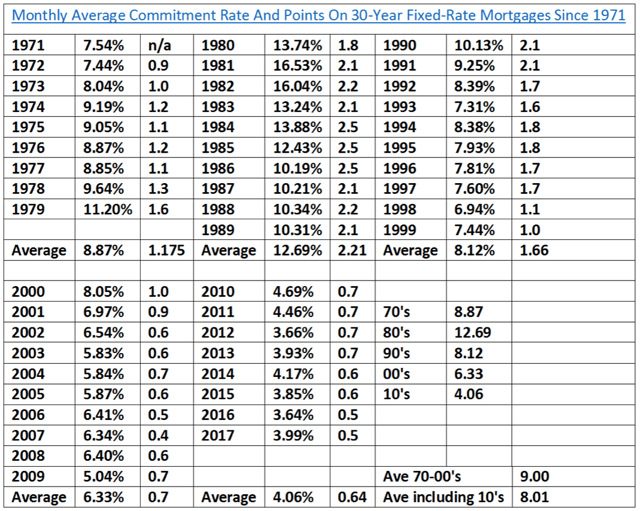

What are you going to do since rates started going up? US mortgage interest rates for the past 7 years have been 2.25% to 4.00% below the average for each of the past 3 decades. See Freddie Mac

Everybody knows the answer is to concentrate on purchase business and ways to get more purchase business but is that easier said than done? I don’t think so. Hopefully you’ve been concentrating on purchase business for the past 3-4 years. Loan officers who have been dedicated to purchase business since 2003, have known that eventually rates must go up.

The good news is 2018 rates are expected to stay below average of the rates we had during the 2000’s. (Forecast) In fact, according to LongForecast.com, they are predicting rates won’t exceed the rates of the 2000’s until 2021.

What is Stockton Mortgage doing to help our Loan Officers and Customers?

How about…

Rate Lock Protections

- Rate Locks for 60 to 90 days

- Extended Rate Locks for new construction up to 180 Days (And longer)

Make Sense Underwriting

- NO overlays down to 580

- Manual Government Underwriting

More Specialty Loan Programs

- FHA\VA\USDA Manufactured and Modular One Time Close

- Conventional Construction Loans (Coming 1st Q 2018)

- 203K (Standard and Streamline) Renovation Loans

- HomeStyle Conventional Renovation Loans

- Third Party Originations with Local Banks and Credit Unions

- Doctor’s Loan Programs

- Mini Farm Program

- Self Employed Borrower Bank Statement Programs

To learn more, Call Rick Koenig Director of Business Development & Recruiting, 513-382-5861 or email rkoenig@smcapproved.com