Fear of making the leap from renter to owner is normal – after all, purchasing a home is one of the biggest financial investments most people make in their lifetime. But did you know that homeownership is one step toward financial security for some?

Kayla Albert with Trulia writes that, for numerous reasons, buying a home could make for a more financially sound future for you than renting.

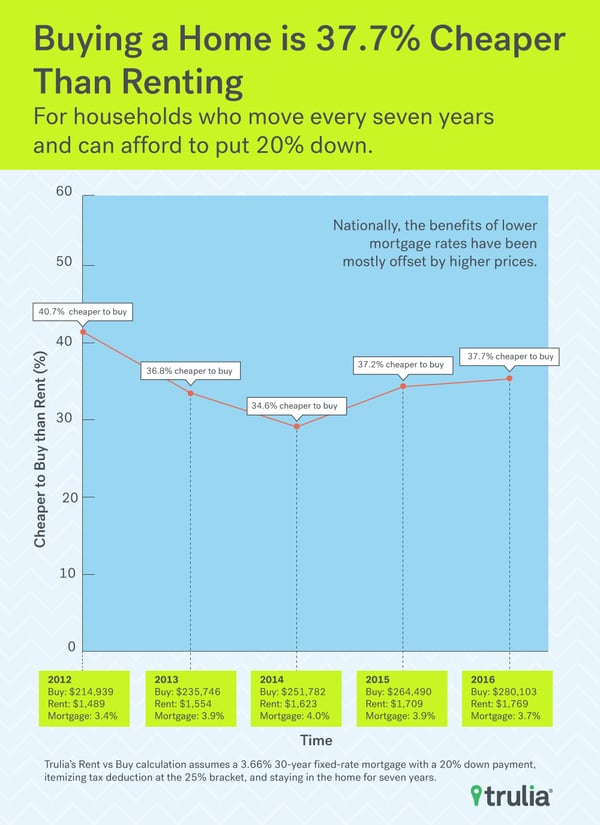

According to Trulia’s October 2016 Rent vs. Buy report, with the recent low interest rates and rising home prices, “buying is cheaper than renting in 100 of the largest metro areas by an average of 37.7%”.

Here are things to consider:

- Mortgage rates can be fixed – Rental prices trend upwards when lease renewal time happens – a fixed-rate mortgage means your principal and interest payments won’t change the entire length of your loan – only property taxes and insurance have the ability to fluctuate.

- You build equity – Having your home paid off and retiring is a good feeling, as most people’s income decreases, once they start drawings social security or retirement. Having a home to call your own and no monthly payment is something that can’t be had by renting.

- Forced savings – If you’re not into saving, paying a mortgage can create a cushion that renting lacks. Albert writes, “Owning a home does not guarantee a higher net worth, nor does it remove the need to be financially responsible, but it does provide a structure within which one can build wealth”.

Some buyers question whether now is the time to make the leap from renter to homeowner. Trulia has created graph to illustrate how buying is cheaper than renting.

For more points on how buying a home can help facilitate financial security, check out trulia’s blog.

Source: https://www.trulia.com/blog/buying-your-first-home-for-financial-security/ , https://www.trulia.com/blog/trends/rent-vs-buy-oct-2016/